In today’s competitive market, online reviews are more than just feedback—they are trust builders, SEO boosters, and sales drivers. Whether you’re a startup or an established business, learning how to get reviews for your business can significantly impact your reputation and customer acquisition.

Consumers trust businesses that show social proof. According to surveys, over 90% of buyers read online reviews before purchasing. So, if you’re not actively seeking reviews, you’re missing out on valuable opportunities to grow.

This detailed guide will walk you through proven strategies, platforms to target, mistakes to avoid, and frequently asked questions to help you collect and manage customer reviews effectively.

🌟 Why Are Customer Reviews Important?

Before diving into the how, let’s understand the why.

Boosts Credibility: Honest reviews build trust among new customers.

Improves Local SEO: Google ranks businesses higher when they have more positive reviews.

Increases Conversion Rates: Positive feedback can turn hesitant visitors into paying clients.

Drives Customer Engagement: Asking for reviews creates a sense of value among customers.

Highlights Strengths and Weaknesses: Reviews provide insights to improve services.

How to Get Reviews for Your Business?

1. Ask at the Right Moment

Timing is crucial. Ask for a review when your customer is happiest—right after a purchase, delivery, or successful support interaction.

Best Times to Ask:

After a service is completed.

When a customer reorders or renews.

After they give positive verbal feedback.

Use language like:

“We’re glad you’re satisfied! Would you mind sharing your experience in a quick review?”

2. Simplify the Review Process

The easier it is to leave a review, the more likely customers will do it.

Make it simple:

Share direct review links (Google, Facebook, Trustpilot).

Include a QR code on receipts or packaging.

Embed review buttons in emails or SMS.

Use a dedicated “Leave a Review” page on your website.

Avoid lengthy forms or multiple logins.

3. Use Email Campaigns Strategically

Email is still a powerful tool for review requests.

Tips for Effective Review Emails:

Personalize the message.

Include their purchase details for context.

Keep the subject line clear:

“How was your recent purchase?” or “We’d love your feedback!”Add a single, prominent CTA:

“Click here to leave your review”

Automate this step through platforms like Mailchimp or Klaviyo.

4. Leverage SMS for Instant Reviews

SMS has higher open and response rates than email.

Keep messages short:

“Hi [Name], thanks for your order! Share your feedback here: [link]”

Ensure customers have opted into SMS marketing to stay compliant.

5. Use Google Business Profile Effectively

Your Google Business Profile (GBP) is a goldmine for local SEO and credibility.

How to Maximize Google Reviews:

Claim and verify your GBP.

Share the unique Google review link with customers.

Respond to all reviews—positive and negative—to show engagement.

A steady stream of Google reviews can push your business higher in local search results.

6. Ask In-Person or Over the Phone

If you run a physical store or provide direct services, ask verbally.

Example:

“I’m glad you’re happy with our work—would you mind leaving us a quick review on Google?”

Train your staff to recognize review-worthy interactions and ask confidently.

7. Offer Freebies (But Stay Compliant)

You can ethically motivate customers to leave reviews by offering:

Discount codes

Loyalty points

Entries into a giveaway

Caution:

Never offer rewards for positive reviews only. It’s against the policies of most platforms and could result in penalties. Ask for honest reviews regardless of the rating.

8. Use Review Generation Tools

If you’re managing reviews across platforms, automation tools save time and effort.

Top Tools to Get Reviews:

Podium

Trustpilot

Birdeye

NiceJob

Yotpo

These platforms help send reminders, monitor responses, and display testimonials on your site.

9. Add Review Requests on Receipts and Packaging

Turn every customer interaction into a review opportunity.

Include short lines like:

“Loved your experience? Tell us on Google!”

“Scan this QR to leave a review”

You can add this on:

Invoices

Shipping labels

Thank-you cards

Product packaging

10. Utilize Social Media for Review Outreach

Your social media followers are often your loyal community.

Ways to ask for reviews:

Create polls or stories asking for feedback.

Add a “Review Us” highlight on Instagram.

Post review shoutouts to motivate others.

Pin review requests to Facebook or X (Twitter) profiles.

11. Display Existing Reviews to Encourage New Ones

Social proof begets more social proof.

Ideas:

Add testimonials on your homepage.

Use review carousels on product pages.

Highlight a “Review of the Month.”

When customers see that others are sharing feedback, they’re more likely to follow.

12. Respond to Reviews Promptly

Responding shows that you value feedback, which encourages more reviews.

Thank customers for positive reviews.

Address concerns in negative reviews with professionalism.

Avoid canned responses—personalization matters.

The more responsive you are, the more trust you build.

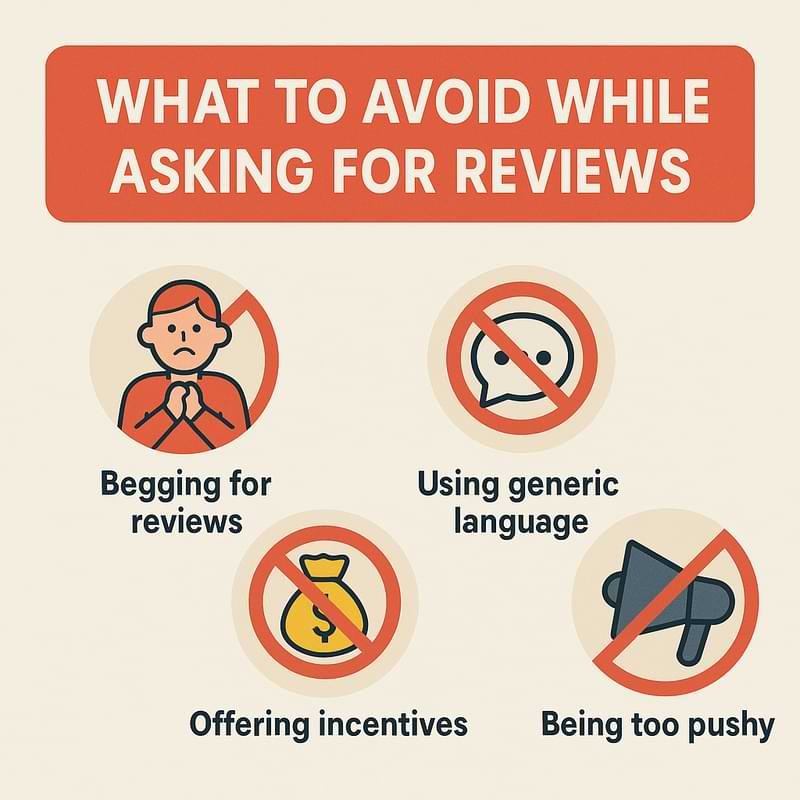

What to Avoid While Asking for Reviews

Don’t be pushy or forceful – Respect your customer’s choice and timing.

Avoid offering incentives – Rewards for positive reviews can violate platform rules and damage trust.

Don’t send bulk, impersonal requests – Generic messages are often ignored.

Avoid poor timing – Never ask immediately after a negative experience; give time for resolution.

Don’t ask only for 5-star reviews – Encourage honest feedback to build credibility.

Avoid complex or long review links – Make it easy and convenient to leave a review.

Don’t ignore feedback – Failing to acknowledge reviews, especially negative ones, can harm your brand’s image.

📈 How to Track Your Reviews

To know whether your efforts are working, track metrics like:

Number of new reviews per month

Average star rating

Review sources (Google, Facebook, etc.)

Review response rate

Sentiment analysis

Use tools like Google Business Profile Insights, ReviewTrackers, or Semrush Review Management.

🏁 Conclusion

Getting reviews for your business doesn’t require gimmicks—it needs consistency, strategy, and customer care. By simplifying the process, asking at the right time, and responding with sincerity, you create a cycle of feedback and trust.

In a world where online reputation can make or break a sale, don’t leave your reviews to chance. Take control, be proactive, and turn every satisfied customer into a vocal advocate for your brand.

❓ Frequently Asked Questions (FAQs)

Q1. How do I ask a customer for a review without sounding pushy?

Be natural and polite. Ask after a positive experience and say something like, “Your feedback would mean a lot to us!”

Q2. Can I offer a discount in exchange for a review?

Yes, but only if it’s for any review—positive or negative. Offering rewards solely for 5-star reviews is unethical and against most platforms’ rules.

Q3. Where should I focus on getting reviews?

Start with Google, then expand to Facebook, Yelp, TripAdvisor, and niche platforms based on your industry.

Q4. How many reviews should a business have?

There’s no fixed number, but consistency matters. A steady flow of recent reviews builds trust more than a high count of outdated ones.

Q5. Should I respond to all reviews?

Yes. A thoughtful response—even to negative feedback—shows professionalism and improves your brand image.

Q6. Can I delete bad reviews?

No, but you can report reviews that violate platform guidelines. It’s better to respond constructively and show how you resolve issues.